Utility and Tax Incentives

Federal, state, and local governments understand the importance of sustainable energy and the high costs associated with traditional power sources. Utility companies can’t afford to maintain their infrastructure costs as homes use more and more power. That’s why, in most cases, utility and tax incentives can save customers well over 50% on the cost of energy.*

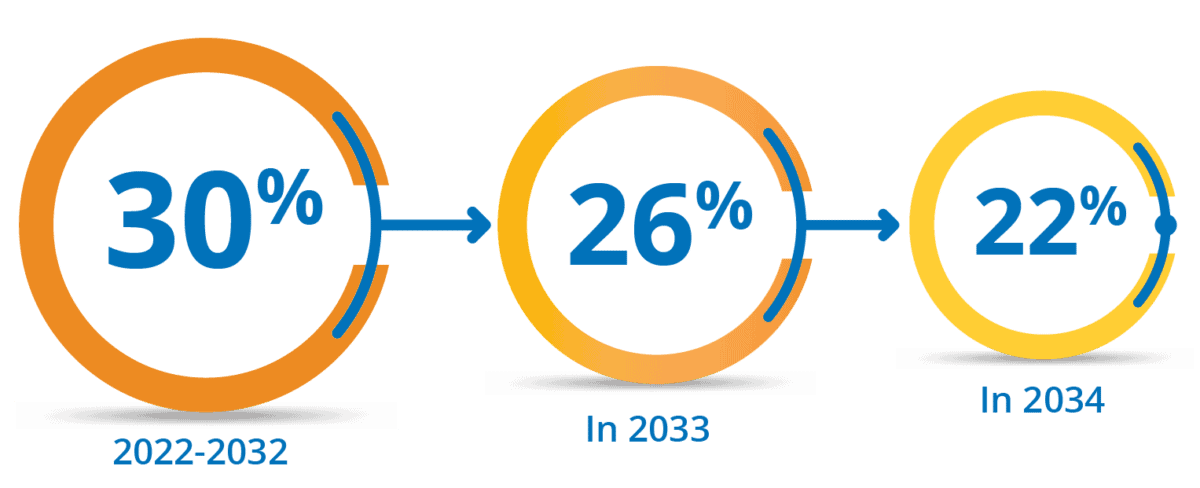

Federal Investment Tax Credit – 30%

The solar investment tax credit (ITC) is a dollar-for-dollar reduction in the income taxes that a person or company claiming the credit would otherwise pay the federal government. The federal ITC is based on 30% of the homeowner or business owner’s cost to install solar from 2022–2032.

Financial Incentives for Business Owners

This aspect is perhaps the most well-known. The Federal Solar Investment Tax Credit (ITC) and 5-Year Modified Accelerated Cost Recovery System (MACRS) have been important drivers in reducing costs for companies going solar. Many other rebates and incentives exist at state, municipal, and utility levels. You can find out more about specific locations by searching the Database of State Incentives for Renewables & Energy.

Federal Tax Credit for Homeowners

The solar Investment Tax Credit (ITC) offers a direct reduction in income taxes for individuals or companies, equivalent to the amount they would have paid the federal government. Specifically, the federal ITC is calculated at 30% of the homeowner’s solar installation expenses. In cases of leased systems, the company manages the collection of this incentive and channels the resulting savings to the homeowner. Act now; by transitioning to solar sooner, you can maximize your savings potential!

State Incentives

California offers many state and local incentives for going solar. The utilities offer incentives such as energy audits and battery rebates. They vary by utility company and location. We will help you attain all of the incentives your project qualifies for.

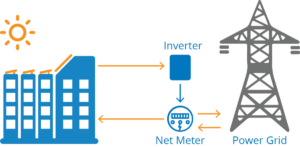

Commerical Net Metering

Commerical Net Metering

The California Public Utility Commission approved Net Energy Metering Aggregation (NEMA) and Net Energy Metering Virtual (NEMV) in 2014, allowing businesses to install a single centralized solar power system to offset multiple meters or facilities. Benefiting meters can be on different rates or even located on different properties, but they must be on contiguous parcels. Net metering (the ability to sell energy to the utility) was central to creating positive financial returns. Changes to the NEM program in 2023 in California will significantly affect the payments, while the other benefits of solar will remain.

Rate Structure Incentives

Rate Structure Incentives

While most companies have heard of net metering, perhaps one of the least talked about but extremely important topics is the role of rate structures. When possible, having the ability to rate switch to the best utility rate structure is extremely helpful to creating a winning financial scenario.

Property Tax Exemption

Property Tax Exemption

Installing solar panels on your home increases its value by up to 20 times your annual energy bill savings. We don’t think you should be penalized for your sustainable decision, and many state legislators agree! Currently, new solar installations will be subject to no additional property taxes based on their assessed value.

Increase Home and Business Property Value

Owning a residential or commercial solar energy system installed on your property is considered a capital improvement that can enhance the overall value of your property. This advantageous feature not only has the potential to expedite the sale of your home or business but also increase its selling price compared to those lacking solar installations. Furthermore, your investment in this eco-friendly and efficient solar power system contributes to the tax basis of your property. When you decide to sell your property, this tax-based investment can be subtracted from the sale price, thereby reducing the portion of the price that is considered profit. As a result, this reduction in taxable profit can lead to lower taxes on the sale and potentially even help you avoid capital gains taxes associated with property appreciation.

*Ask your representative about which incentive you’re eligible to receive. Please consult a tax advisor on your ability to claim these nonrefundable tax credits.

![california-licensed-contractor[1]](https://rcsolarandroofing.com/wp-content/uploads/2021/01/california-licensed-contractor1.webp)